mScanAPI

Match Payments Across Every Step of a Customer’s Journey

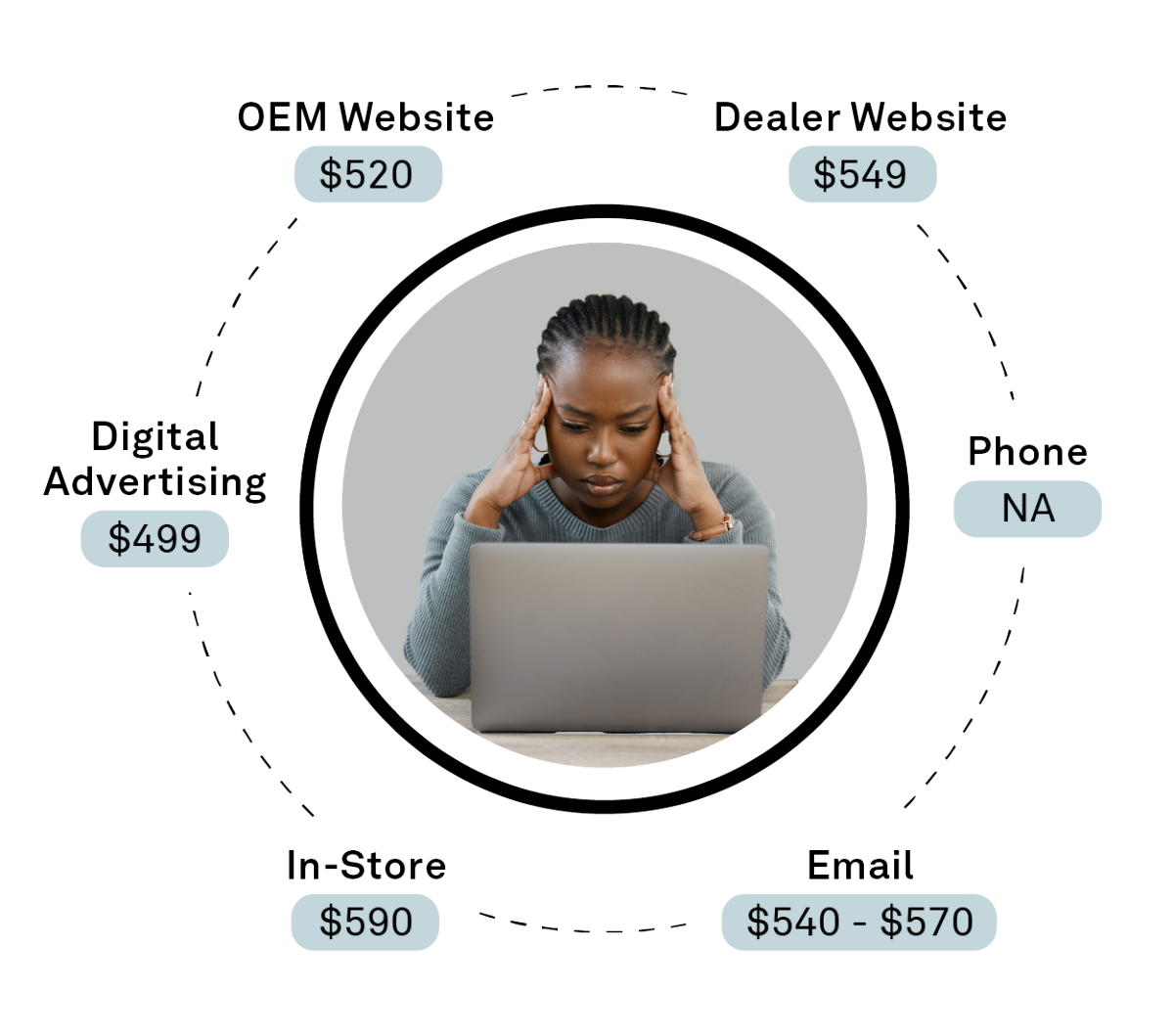

Align with your customer’s unique demands and online shopping tendencies by using comprehensive data, sources, and automotive expertise to power your solutions. mScanAPI tracks every single parameter of every published vehicle retail lender program ensuring accuracy and reliability across each channel they use while purchasing a vehicle.

Unrivaled Accuracy in Payment Calculations

Anything that can affect a payment is tracked through mScanAPI. Our solutions consider four classes of data:

- OEM

- Lender

- Dealer

- Municipality

Our calculation engine is built with detail, giving your operations the ability to match any one of these methodologies a dealer uses.

Lightning-Fast Incentive Data Integration

Gain access to daily-updated incentive information to enable instant promotions, streamlining retailers’ sales cycles. Our API’s speed, accuracy, focus, and scale

provide our customers with the ability to:

- View vast quantities of data that can be extracted instantly.

- See any combination of a payment through a customer’s lens.

- Analyze flexible UI custom reports that is granular down to the zip code.

- Be consistent with pricing across all advertising channels.

Complex Payments Made Simple

mScanAPI supports a wide range of standards, ensuring compatibility for any transaction. Empowering you to customize every aspect of the process, tailoring it to your unique needs.

Frequently Asked Questions