by Michelle Yeung, Tom Libby, Matt Trommer

It’s been a turbulent four years for the US auto industry, from the COVID-19 pandemic to inventory fluctuations and supply chain disruptions.

But unfortunately for some of the industry’s most important stakeholders, the turbulence isn’t over yet. Automakers and their captive financing groups are facing intensified competition and difficulty attracting customers, due to several converging trends. These range from a recent surge in vehicle inventory and affordability concerns to fluctuating incentives and evolving consumer behaviors.

Here’s a breakdown of how these trends are playing out in 2024, and what they mean for OEMs and captive lenders

Rising Inventory: More Cars, More Challenges

In August 2024, the number of vehicles available for sale in the US jumped to 2.88 million— Still, there are some signs that overall inventory growth is slowing, with year-over-year comparisons showing a steady decrease in the last few months; after March inventory marked a 63% increase year over year.

But with more 2025 model year vehicles entering the showrooms this September and October, pressure will again accelerate to sell down remaining stock of 2024 vehicles. There are still 2.07 million model year 2024 vehicles in retail advertised inventory. For comparison, at this same time last year, there were only 1.33 million model year 2023 vehicles in advertised inventory.

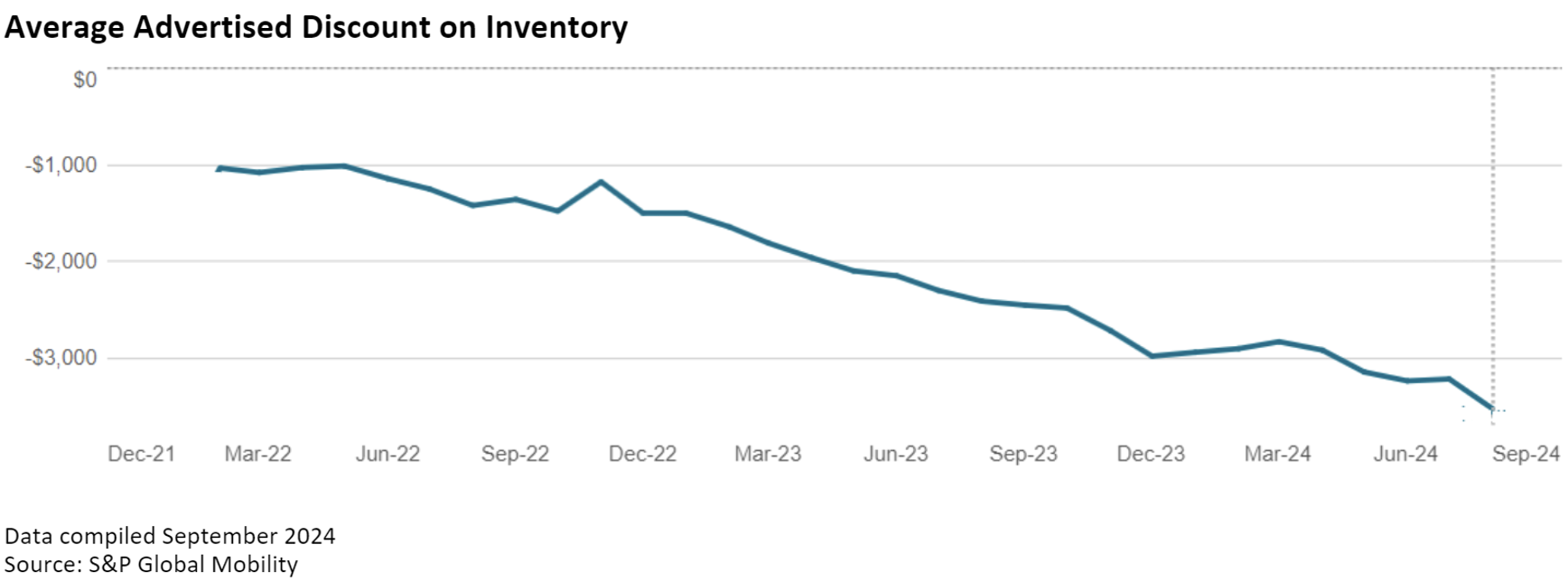

This increase in inventory, especially with the 2025 models now rolling out, means dealerships need to clear out their 2024 models. To do this, they’re offering bigger discounts — about $3,534 on average in August, which is 10% more than in July and 40% higher than they were offering at this time last year.

For lenders, this signals a shift to a buyer’s market, where competitive financing will be key. Captive lenders might see more opportunities to offer attractive financing options like leasing to help move these vehicles.

Affordability and Incentives: A Continuing Roller Coaster Ride

Even as the market shifts in the buyers’ favor, vehicle prices remain a hurdle for potential shoppers. The average MSRP in retail advertised inventory reached over $51,900 as of August 2024. This, combined with high interest rates, has made affordability a big concern for buyers. Even following the Fed’s September announcement to cut interest rates by 50 basis points, borrowing costs remain considerably higher than pre-pandemic and are still a critical headwind facing prospective buyers in the market.

With buyers feeling the pinch, captive lenders will need to think about how they can help make car purchases more affordable. Offering flexible loan terms, competitive interest rates, and utilizing leasing programs could help ease some of the financial stress for consumers.

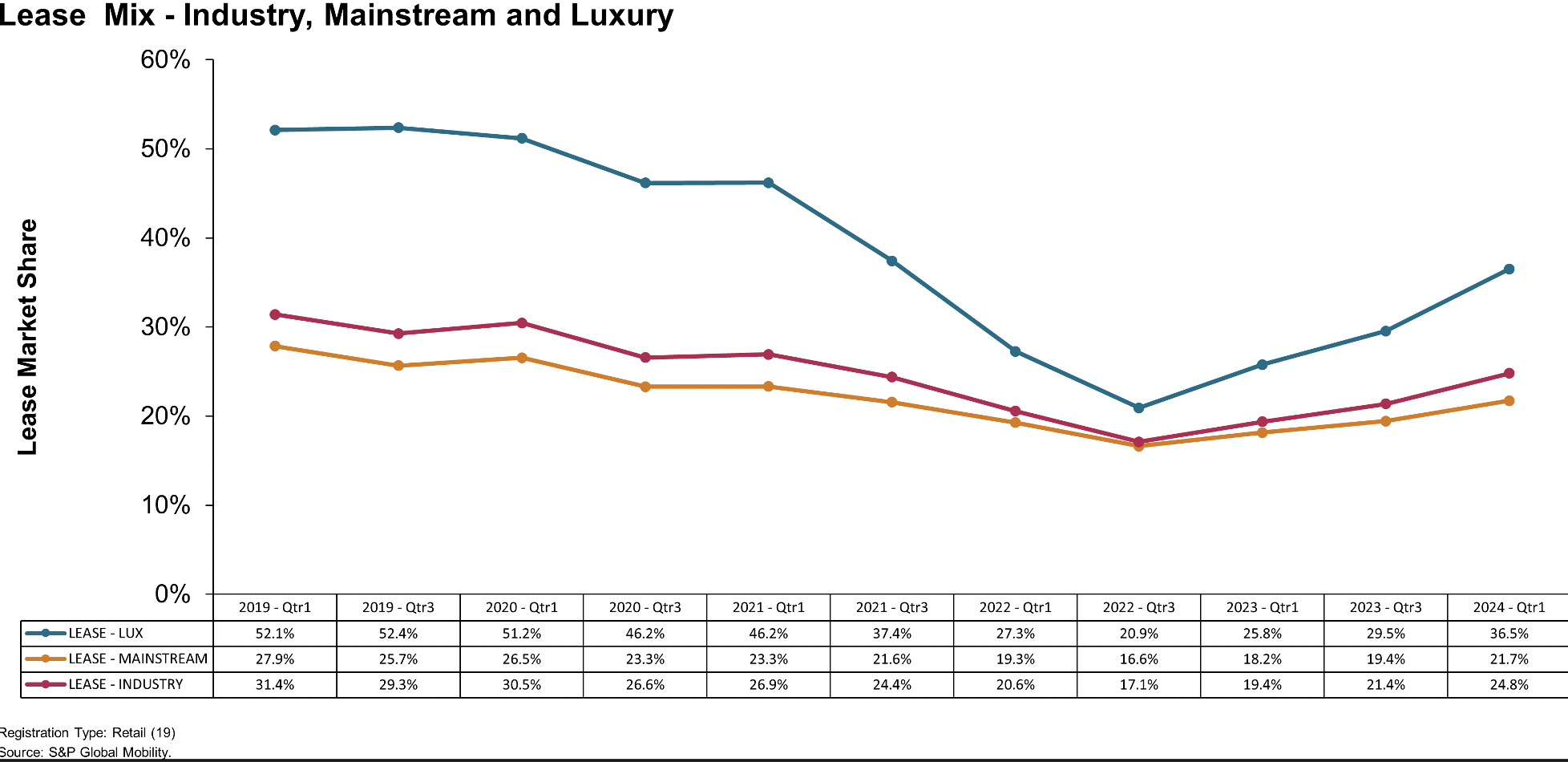

During the COVID-19 pandemic, automakers and their lending arms faced unprecedented challenges. They reduced leasing options and incentives due to severe inventory shortages and heightened consumer demand, which resulted in historically low leasing rates.

As the market begins to stabilize, OEMs now find themselves contending with record-low returns from lease customers due to that multi-year leasing decline. In response, they are being forced to implement targeted incentives to sustain market share and stimulate sales.

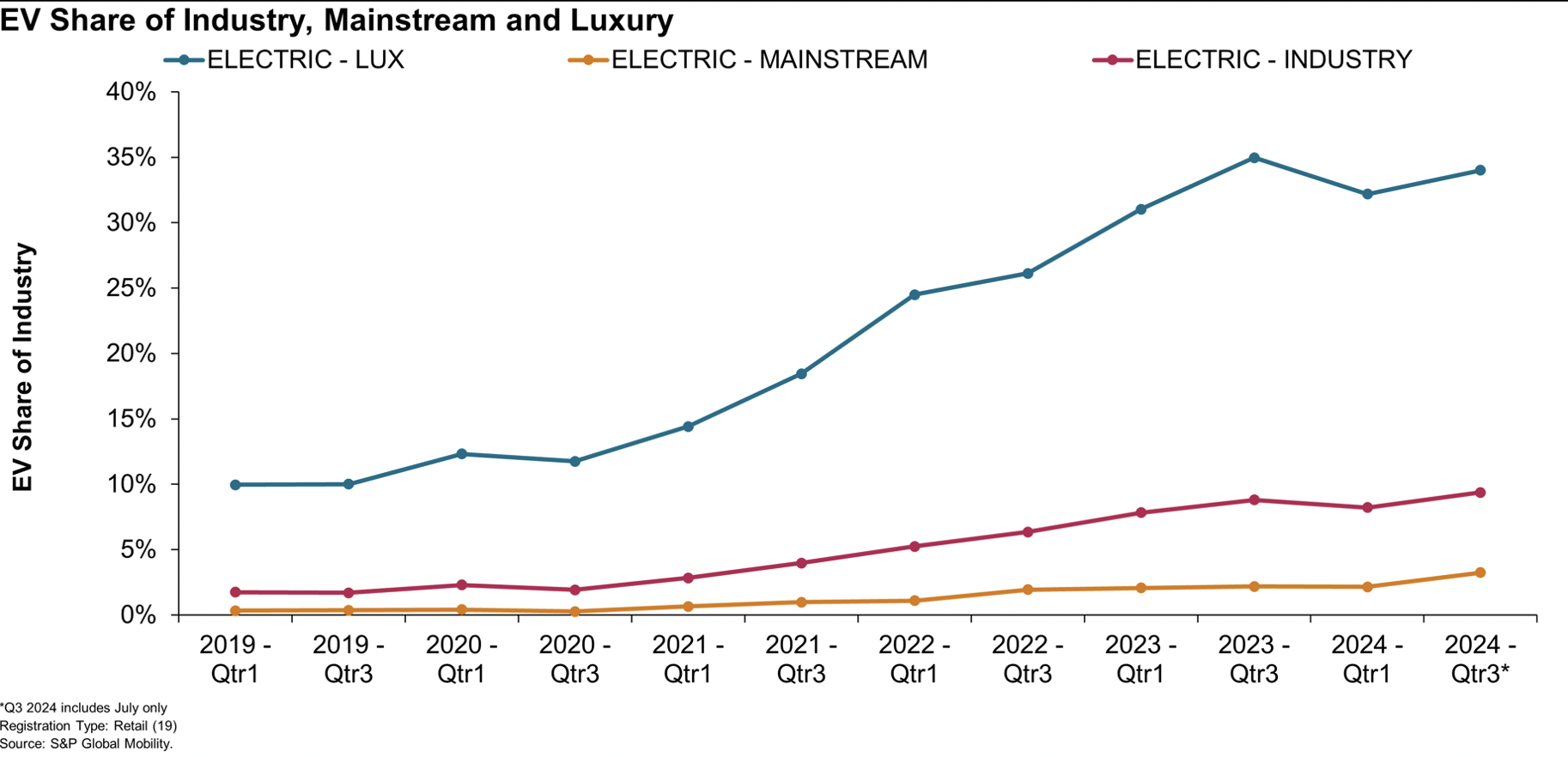

On top of making up for the lack of returning lease customers, automakers must also prioritize their electric vehicle (EV) sales. However, the lack of robust infrastructure and consumer education around EVs has made it costly for manufacturers to promote these vehicles effectively. In turn, OEMs have had to allocate a greater share of their incentive spending for EVs rather than ICE vehicles, creating more selling pressures on the ICE vehicles.

OEMs striving to balance these portfolios will face the challenge of managing incentives across different vehicle types.

Additionally, the complexity surrounding government rebates for EVs — stemming from the Inflation Reduction Act (IRA) and various state initiatives — has created a convoluted landscape for OEMs, lenders, dealers, and consumers alike. The intricate nature of these incentives complicates the purchasing process, making it difficult for consumers to navigate available options. This complexity can lead to confusion and frustration, ultimately impacting consumer decision-making and sales outcomes.

For captive lenders, this means understanding the changing incentives landscape is crucial. Keeping up with the latest rebate programs and incentives can help in tailoring financing options that match current market conditions. Also, providing clear information to customers about these incentives can help simplify their decision-making process.

Leasing: Making a Comeback

In some good news for OEMs, leasing is making a strong comeback, with its share of new vehicle registrations rising from its low point of 17.1% in mid-2022 to 25.3% in Q2 2024.

This rise is partly due to higher dealer inventories. Back in 2022, brands and dealers had substantial leverage given the lack of vehicles to choose from, but since then market clout has moved back to the consumer, requiring higher incentives and discounting by dealers. which in turn has led to greater leasing.

The rise in leasing can also be attributed in part to the Inflation Reduction Act, which offers a $7,500 tax credit for EV leases.

Among vehicle types, lease share of luxury vehicles has risen much more (almost 19 percentage points) than mainstream (up 5 percentage points) or the industry overall (up 8.2 percentage points) since 2022. This dramatic rise in leasing of luxury vehicles began at the same time the Inflation Reduction Act (IRA) came into effect. Given electric vehicles’ disproportionate share of the luxury market, this has propelled both lease share of luxury and lease share of industry to jump.

For lenders, this means there are more opportunities to offer leasing options. Captive lenders have the opportunity to grow their business with a concerted effort to focus on leasing.

A Competitive Landscape

The automotive market is in flux with rising inventory, affordability issues, and complex incentives structures. For captive lenders, adapting strategies to meet these trends as well as the evolving needs of customers should be paramount. Offering flexible financing solutions, understanding the availability of competitive incentives, and providing clear information can help captive lenders stand out in a difficult selling market.

Get the most comprehensive, accurate and timely vehicle registration and loyalty data with automotive loan origination activity.

Learn More About AutoCreditInsight

Also: Access our tool that allows OEMs and lenders to compare any vehicle payment against competitors in real time.

Meet us in person at the Auto Finance Summit: