In February 2024, Ford Motor Company significantly reduced the MSRP of its 2023 Mustang Mach-E due to rising inventory and days’ supply. Read on to understand the market conditions that prompted this decision, its impact, and what Ford achieved as a result.

Table of Contents:

Situation

Ford Motor Company announced its first Mustang Mach-E, an electric SUV, at the end of 2019, with the 2021 model launching in late 2020. The vehicle was a hit, even winning Car and Driver’s first Electric Vehicle of the Year Award in 2021. However, production struggled due to industry-wide supply constraints, resulting in long lead times. Ford managed to ramp up production between 2021 and 2023, anticipating higher customer demand, but demand fell short of expectations in the final months of 2023.

In the first quarter of 2024, the company observed declining sales of its 2023 model. This was partly due to fluctuating demand caused by the loss of government rebate eligibility, economic changes, and consumer uncertainty about EVs in general.

However, other factors contributed to these declines.

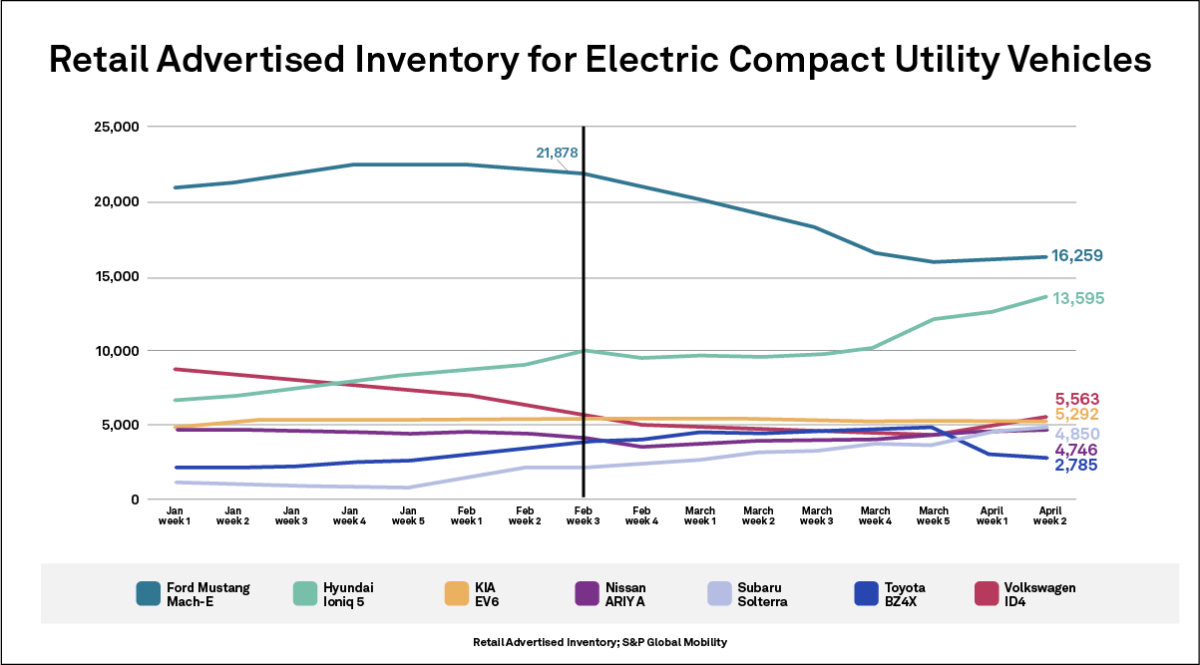

By 2023, the electric compact utility segment had eight competitors, including the Mach-E. Historically, the Mach-E had the highest advertised inventory, which continued to rise until November 2023 and remained high into the new year. As of January 2024, the Mach-E’s inventory exceeded 22,000 vehicles, while all competitors had inventories of about 8,000 or lower.

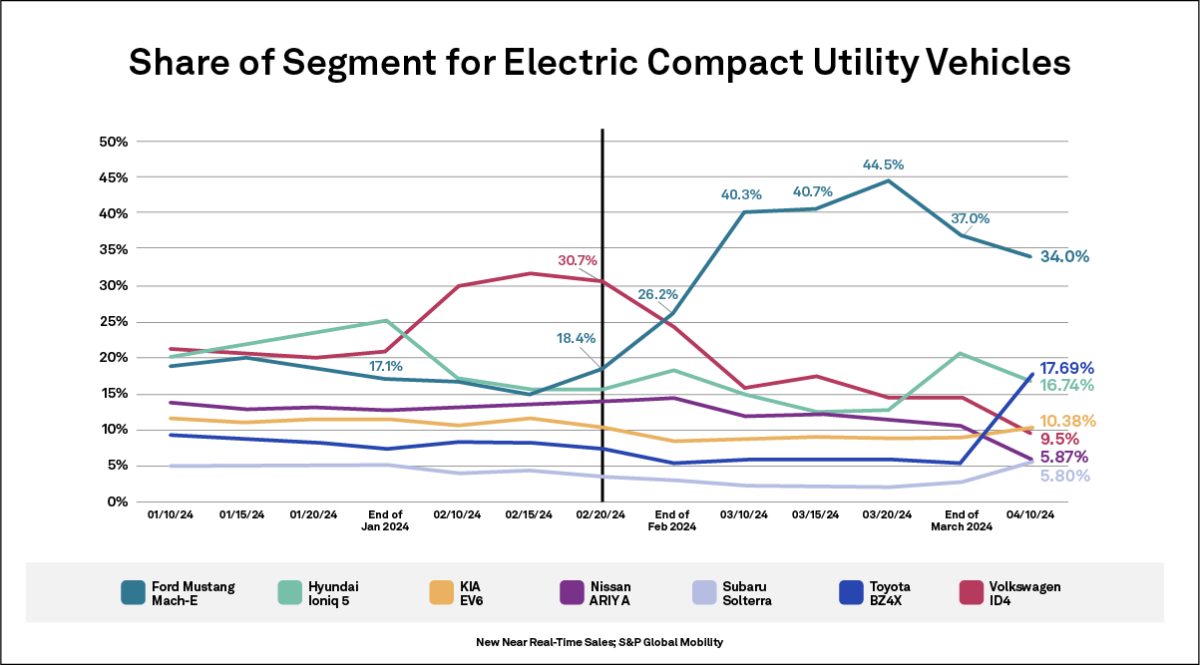

Simultaneously, the Mach-E experienced its lowest segment share in nine months, dropping from a peak of 32.2% in September 2023 to 17.1% in January 2024. Although still among the top three in the segment, its competitors saw much less fluctuation.

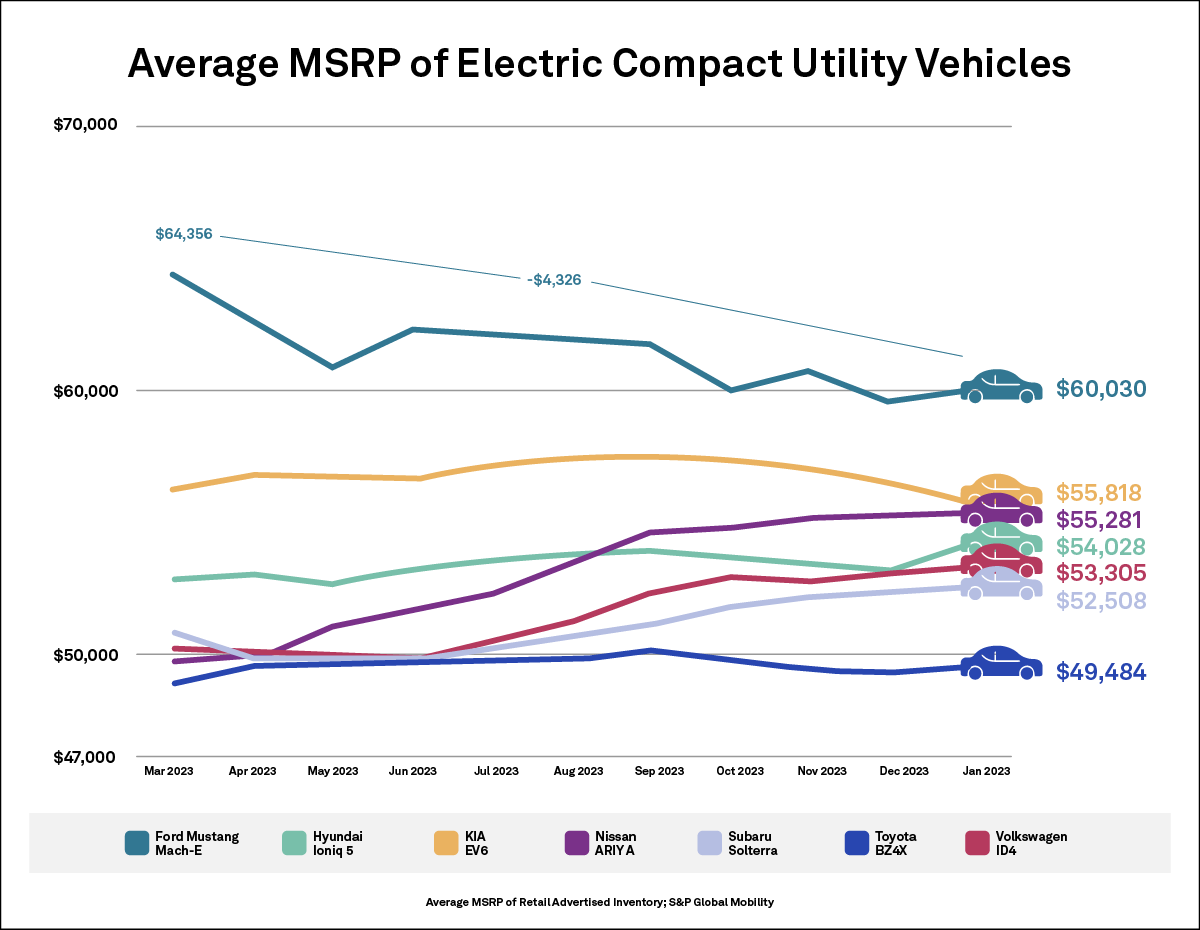

Additionally, the Mach-E’s price was significantly higher than its competitors. In March 2023, the average MSRP of Mach-E inventory was $64,356. This decreased throughout the year, hitting a relative low of $60,030 in January 2024 as lower trim levels became more prevalent. Despite this $4,000+ decrease, the Mach-E’s price remained significantly higher than other vehicles in the segment; the Kia EV6, the second most expensive vehicle, was priced around $56,000 on average in January.

Meanwhile, dealerships were offering incentives and rebates on the Mach-E, making the price drop even steeper from their perspective. The average dealership price, which was $64,681 in March 2023, had decreased to $56,105 by January 2024. This was still significantly higher than the second most expensive vehicle from the dealerships’ viewpoint—the Nissan Ariya, priced around $52,000.

These pricing factors, combined with the loss of a $7,500 government rebate, led to a slowdown in sales in January and an increase in days’ supply. In January 2024, the Mach-E had a staggering 556 days’ supply—more than a year and a half—while all competitors had fewer than 200. A 60 days’ supply is considered balanced, highlighting the selling challenges in the segment overall and compounding the Mach-E’s sales difficulties.

Challenge

Ford’s difficulties in selling the 2023 Mach-E are evident in hindsight. However, at the time, competitors who had access to real-time data on the Mach-E’s pricing and incentives fluctuations could see that Ford needed to reduce inventory. They could also use this data to adjust their own pricing strategies to their advantage, anticipating Ford’s inevitable move.

It’s uncertain whether Volkswagen had access to this real-time data, but the VW ID4 clearly benefited early in 2024 as the Mach-E’s market share declined. The ID4’s market share increased from 21.1% in the first 10 days of January to 31.6% in the first 15 days of February. Meanwhile, the Mach-E’s share dropped from just under 20% to 15% over the same period.

Even without considering the competition, Ford needed to act quickly to avoid cannibalizing its own sales. With Mach-E inventory peaking in November 2023 and remaining high in January 2024, Ford had to clear out the 2023 models before the 2024 models were released. Orders for the new model opened in mid-April, which risked further reducing customer interest in the previous year’s inventory.

This intelligence is not only available but also digestible and actionable through S&P Global Mobility’s Incentives Monitor tool. OEMs with this tool receive real-time (live) alerts to pricing and incentive changes across the industry down to the trim level and can even organize the information by region. They can then make pricing adjustments based on sales goals and their market position among competitors.

Approach

Ford made an unusual choice for an OEM: to stimulate sales, the company decreased the MSRP of the 2023 Mach-E in mid-February instead of running incentives.

The effects were almost immediate. The average MSRP of Mach-E inventory dropped from $59,765 in early February 2024 to $54,285 by the end of the month, a decrease of nearly $5,500. By mid-April, the vehicle’s price reached $52,775, positioning it in the middle of competitors’ prices.

Dealerships were already running incentives, so the initial price drop was less dramatic—from $55,696 to $51,716, a decrease of almost $4,000. After dealership incentives, customers were paying $49,748, positioning the Mach-E at the top of its segment, but just barely above the Nissan Ariya, the second-most expensive.

Following this change, the Mach-E’s segment share soared, peaking at 44.5% in March. Inventory dropped from 21,878 vehicles in late February to 16,259 in late April. Days’ supply dramatically decreased from 638 to 97 over the same period. Ford successfully moved inventory quickly before orders for the next model year opened.

This MSRP reduction was a one-time fix addressing a months-long challenge. While running incentives could have achieved a similar price decrease, long-term incentives might have led customers to suspect there was something wrong with the vehicle, ultimately hurting sales. Additionally, customers not tracking Mach-E prices closely would not have been alerted to the MSRP reduction.

Opportunity

It’s no secret that EV sales have slowed in recent months. Analysts suggest that early adopters have already made their purchases, while other customers are not yet ready to make the switch. Meanwhile, demand for plug-in hybrid electric vehicles (PHEVs) has increased as curious customers seek an introduction to the technology. As demand continues to fluctuate, OEMs will need to adapt their strategies, much like Ford did.

There are patterns to observe here: major price outliers can face challenges within their segment in terms of inventory, days’ supply, and segment share.

For Ford specifically, it’s interesting to analyze the customers who purchased Mach-Es after the MSRP decrease. At the time of the price reduction, about 10% of new Mach-E buyers were existing Mach-E owners looking to upgrade, and around 40-50% were Ford owners. The decrease in MSRP significantly boosted the number of customers purchasing Mach-Es; however, the mix of buyers remained relatively stable, with a similar proportion coming from previous Mach-E owners and Ford owners.

Ford successfully moved inventory it had previously struggled to sell after decreasing the MSRP, which was crucial with the 2024 Mustang Mach-E close on the heels of its predecessor. However, aligning more closely with the market from the start and running incentives as necessary can lead to more consistent sales throughout the year, preventing the need for drastic MSRP adjustments. Historical data, combined with real-time pricing and incentives updates, such as those from our S&P Global Mobility – Market Scan portfolio, can keep OEMs informed of their market position and guide their pricing strategy.